Valuers are Valuers — Building Insurance Valuations

Specialised field

Building Insurance Valuations for strata and community schemes is a very specialised area. Each State has differing requirements, ranging from ‘obtain a valuation’ (VIC), ‘full replacement value’ (QLD), ‘replacement value’ (SA+WA), NSW has an error in the legislation which should be limited to replacement value (as in the earlier Act) and not include reinstatement, and each vary in the description of the improvements with some specifying what other items need to be included.

Recently there has been confusion and concern amongst many within the strata profession about incorrect information requested by an insurer regarding the instruction of a Valuer for building insurance valuation purposes. Despite them stating it is ‘best practice’ and ‘standard operating procedures’, it is not endorsed by any industry body.

The purpose of this article is to create clarity in the engagement of a valuer for the purpose of insurance in strata and community schemes.

A valuation report ‘must’ include items that are within the professional scope of a Valuer or it would recklessly breach typical Valuers’ professional indemnity insurance requirements and leave the lot owners exposed. If requested with items outside of professional scope of a Valuer, it can force a significant cost burden upon lot owners to obtain other specialist reports, before the Valuer can be instructed.

The Valuer IS NOT responsible now and into the future for any calamity, change in Council policy or town planning; unforeseen construction costs increases; or whether the property will be affected by bushfire, flooding, or landslip and the extent thereof; any future acquisition by any acquiring authority; or whether the property would somehow have restricted access in the future; or make allowance for some unknown future catastrophic event. A Valuer is not a clairvoyant.

All of the above risks are generally assessed by actuaries and others within insurance and underwriting companies. It is NOT up to the Valuer to somehow guess to what risk the insurer would be exposed. Simply put, it is the insurers’ role to assess risk, and measure against the type of policy that they utilise.

In the extreme, it is as absurd and as fanciful as requesting that the Valuer predict when and how the property would be damaged or destroyed in the future, and provide the date and time of that event.

Who is responsible

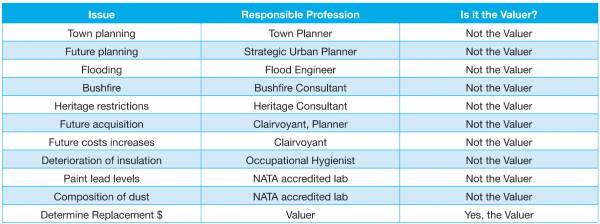

In addition to the Consent Authority for any development application, this table sets out the correct areas of responsibility.

The Valuer cannot predict the future, ie

• what delay may occur in a development application

• who might object to a proposed development

• the delay in settling matters in Court

• changes in town planning

The Valuer must

• check the measurements of improvements on site

• identify the different building cost components

• adopt appropriate rates m2 for each of those components

• check those rates adopted against ‘real world’ costs

• calculate the replacement cost of the improvements

Improvements

Typically include all buildings, footpaths, driveways, fences, services, landscaping, other common property such as pools, tennis courts, bbq areas.

Reinstatement

Where the improvements are damaged but not destroyed. Reinstatement would include using similar materials to the existing improvements, ie calcil bricks, blue stone, etc, rather than a ‘new for old’ basis.

Replacement

Where the improvements are destroyed, ie the site is cleared and improvements are rebuilt (from scratch) in modern materials and to current construction and compliance standards.

Why modern materials

Simply because it is practical and cost effective, and the quality and specifications are generally known (you wouldn’t engage a convict to re-create ‘new’ old convict bricks).

Conclusion

A Valuer in strata properties is a professional who can help you to determine the proper replacement cost of your improvements. However, it is important to understand that the Valuer’s Report does not include the value of the land, any tenant’s fixtures or fittings, or any environmental or town planning constraints.

If your insurer is requesting that Valuers provide information outside the scope of a Valuer’s professional standards and thereby putting your Lot Owners at risk, then consider using another insurer.

Wal Dobrow has been a valuer for over 35 years and is one of three people appointed by the Coalition of Australian Governments (COAG) to determine the qualifications, training and experience of all Valuers in Australia; he has a Meritorious Service Award from the Australian Property Institute (API); wrote the majority of the Expert Witness Technical Information Paper and Resource Kit; and currently serves on the API NSW State Board.

View Comments

(0)