Strata Insurance Report

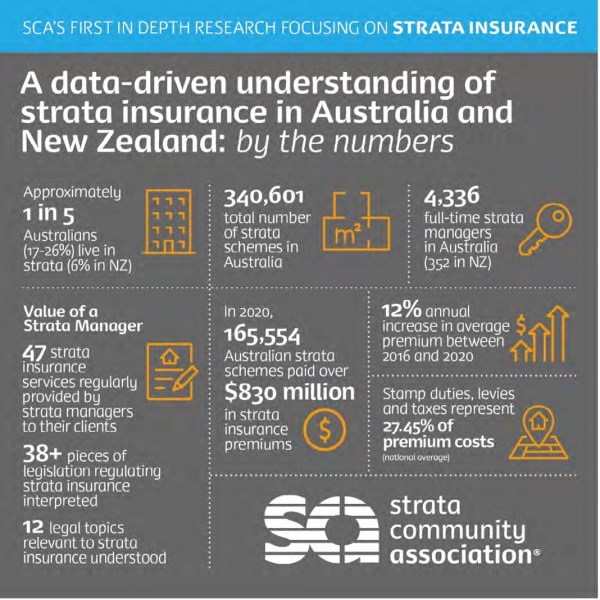

On 7 September 2021, SCA National launched an industry-first A Data-driven Holistic Understanding of Strata Insurance in Australia and NZ report.

In previous editions, we have previewed its release, spoken about the processes we followed to gather member and industry input, including the formation of the Strata Community Association National Strata Insurance Taskforce (SCANSIT), the reasoning behind SCA commissioning the report and our plans for advocacy.

This edition, we will be recapping the report’s launch, including the event, communications, media coverage, advocacy, data, recommendations and a short recap of the highlights.

The launch event

The event was incredibly well attending, with more than 850 participants from across the strata, property and insurance industries as well as other key stakeholders.

Running for an hour and half, the event featured a panel comprising Dr Nicole Johnston (report author), Alisha Fisher (SCA National CEO), Andrew Chambers (SCA National President) and Greg Nash (SCA National Strata Insurance Taskforce Chair).

The panel guided attendees through the three biggest issues from the report, namely:

• The value of the strata manager

• Affordability and availability issues

• Strata service models.

We received more than 80 questions in the online chat function of the digital software platform, showing great engagement from members and stakeholders and of which the panel were able to answer 18 on the day.

The report communications

SCA National has been very busy creating explainer videos (four), infographics (six) and animations (three) to explain what is a very complex topic area. They can all be found on our website. Our Facebook and LinkedIn engagement in particular have increased more than 50% through this time period, with views and engagements significantly higher than experienced at other times of the year.

To unpack such a complex issue area that has been identified as such as priority for the industry, we have ensured that these communications have not come out all at once. Since 7 September, we have promoted and launched three of the videos, three of the infographics and two of the animations, with the remainder to come between now and the end of the year.

All members have been receiving regular email communications detailing the report’s findings, events, roadshows and other activities and these too will continue until the end of the year.

Please follow us on Facebook, LinkedIn, Twitter or Instagram if you do not already.

The report media attention

SCA National put significant effort into ensuring that the report was promoted to the most important stakeholders and the general public through a media relations campaign.

The campaign was extremely successful, generating more than 20 stories covering the report (and many more syndications) comprised of positive coverage in industry and mainstream publications including Insurance News, Smart Property Investment, The West Australian, ABC Regional Drive Radio, The Property Tribune, ABC Kimberley, Insurance Business Magazine, Look Up Strata, Real Estate Business, Smart Strata and other publications.

The report data

The report has detailed data breakdowns regarding strata insurance for each of the jurisdictions in Australia and in New Zealand. This data is incredibly useful when illustrating to clients, government or other stakeholders the importance of what strata managers do, and how much in many cases, premiums have increased for strata communities and how much stamp duties, taxes and levies have contributed to those increases.

The report highlights recap

Videos and media release are located at the dedicated report website strata.community/strata-insurance-report

Although in the previous editions of Inside Strata, we spent time previewing the major highlights from the report, they are worth highlighting again in condensed, bullet point form:

• Owners corporations (OCs) paid more than $1bn for insurance in 2020, $830 million of which was premiums and $230 million in duties, levies and taxes and from 2016 to 2020 the average annual total cost of insurance for OCs increased from $4,320 to $6,522.

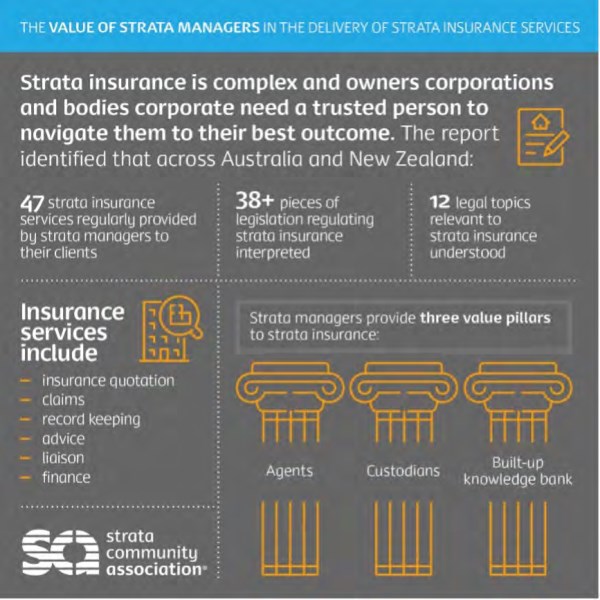

• There are at least 38 pieces of legislation and associated regulations across Australia and New Zealand that regulate the strata insurance industry.

• Fee structure for insurance is often bundled into an agreed services fee, with some strata management businesses offering fee-for-service models.

• The strata manager value proposition in the insurance process has three ‘value pillars’

• There are 47 strata insurance services that are regularly provided by strata managers to their OC clients, and many are not well recognised or understood.

• The strata insurance supply chain is complex, and each party provides value to the final product and outcome.

• Aside from New Zealand and Tasmania, all jurisdictions have implemented laws requiring commissions received by strata managers to be disclosed to OCs or OC representatives.

• Less than 40% of lot owners surveyed indicated that insurance commissions should be abolished. 30% sought improved regulation and 30% were unopposed to commissions based on their knowledge. The majority of lot owners opposed to commissions-based remuneration changed their position if it affected their agreed services fee by at least 25%.

• Affordability and availability are particularly acute issues in Northern Australia

• What is happening next? What is SCA doing with the report?

The report recommendations recap

Key report and industry recommendations

• The report recommends abolition of duty on strata insurance premiums (p156).

• The report recommends an analysis of ‘stacking taxation’ and ‘double taxation’ for example with GST (p156).

• The report recommends replacing emergency levies with general revenue/generally applied property taxes/rates.

• SCA recommends better regulation and oversight of the building and construction industry, particularly in relation to certifying work on high-claim areas such as water or fire.

• SCA recommends increase mitigation funding in high risk areas of Australia.

• SCA wants to work with government and stakeholders to recognise the value the strata manager bring to the insurance process and work with the whole industry supply chain to improve understanding, transparency and disclosure.

The report advocacy

Following the day of the launch, copies of the report were sent to government ministers, MPs, Senators and departmental officials, as well as stakeholders within two goals – to brief them on the report content and to request a meeting to discuss our advocacy points further.

SCA National and each of the SCA state and territory offices have been incredibly successful at securing meetings with ministers, MPs and Senators and have conducted across all jurisdictions, have conducted or secured more than 20 briefing sessions or meetings based around advocating the report’s contents with relevant, high-level officials.

Ministers with portfolio responsibilities and their advisors have been very receptive to report’s contents and complimentary of its exploration of an area that had not been chartered before, and its ability to increase their understanding and ability to make better decisions. Meetings with advisors in both the Treasurer and Assistant Treasurer’s office have been very positive.

We continue to work closely with the Federal Government’s Treasury Department who we have met with twice previously and are executing the creation and implementation of the reinsurance pool and Strata Title Resilience Pilot.

If you have any questions about the report or its advocacy, please contact Shaun Brockman, National Policy and Advocacy Manager

View Comments

(0)