Not 1 But 4 Catastrophic Events! Is it Too Early to Review 2020?

It may seem premature to already be reviewing 2020, but more has happened since the beginning of Summer 2019 and throughout 2020 than in any of the 10 preceding years.

Last Summer will primarily be remembered for the bushfires that ravaged Victoria, New South Wales, South Australia, and Queensland. These were declared a catastrophe by the Insurance Council of Australia (ICA), as our skies glowed orange and the air was laden with heavy smoke drifting across Sydney, Canberra, and Melbourne. Our fields, forests and farms were blackened, homes and businesses decimated, and our rural communities devastated.

The loss of homes, livelihoods and animal habitats will take a long time to recover, and some may never return as they once were. The total estimated insurance losses for this devastating season of bushfires is $2.33bn. But it’s even harder to place a dollar value on the emotional toll to those affected.

However, the Summer of 2019/2020 will also be remembered for the November hailstorms in south-east Queensland, where estimated losses exceeded $480m. The damage was widespread and many dwellings, strata properties and agriculture were battered by the relentless onslaught.

” 2020 will be remembered as a year like no other and we will be telling our grandchildren the horror stories of lockdown, loss of freedom and natural disasters. It’s a year that all staff at BCB came together as one to tackle the staggering number of claims and to assist each other and our strata communities.”

– Warren Fenton, State Manager – QLD

Then in January 2020, ACT and NSW experienced one of the most destructive hailstorms in recent years, with hail stones reportedly between four and five centimetres in diameter falling across Belconnen, Acton and in Canberra’s inner south. Emergency units were withdrawn from fire grounds to assist with emergency calls, effectively moving from one disaster to another.

The ICA estimated insurance losses from the combined hailstorms in Victoria, ACT and NSW to be $1.625bn. The simultaneous storms were declared as one catastrophic event, which also included extreme rain and wind in Queensland.

” Not since 2011 have we experienced multiple catastrophes in the one year. In 2011 Brisbane city and surrounds was ravaged by flood and in Far North Qld Category 5 Tropical Cyclone Yasi devastated strata properties and whole communities, property, and agriculture. BCB’s technology may have changed in the intervening years, we have long thrown away the fax machine, but our commitment to our clients in times of disaster has not faltered”

– Robyn Webb, National Claims Manager

But mother nature wasn’t finished. The terrible weather conditions continued into February 2020, where severe damage was caused by an East Coast Low across south-east Queensland, coastal and inland NSW and ACT. This caused an estimated $958m in insurance losses from a substantial 100,384 claims lodged. Most of the claims for property damage came from Queensland and coastal NSW, largely caused by strong winds and heavy rain. The ICA declared this a catastrophic event.

Together, these four catastrophic events received more than 297,780 claims with staggering losses of almost $4bn.

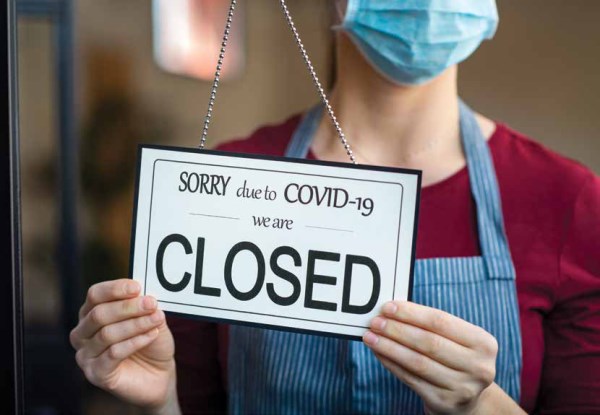

And Then Along Came COVID-19…

And all this was before the word COVID-19 entered our vocabulary. The global health pandemic, itself declared a catastrophe by the ICA, created its own level of complications, limiting the physical response that is normally associated with catastrophic events. However, in the spirit of being “in this together”, insurers and brokers worked tirelessly within the severe restrictions to get assessors and tradespeople to where they needed to be. In a time of such crisis it was a wonderful example of our ecosystem coming together to work as one in the best interest of the communities we serve to protect.

To ensure we can make timely decisions and take positive action, BCB regularly updates its Business Continuity & Resilience (BCR) framework. Our BCR team takes necessary steps to initiate immediate action in times of catastrophe and, with offices nationally ready to assist each other, our reaction is not limited to one location as we pull in our experienced staff to help.

The catastrophic events over the last year were unconfined in their ferocity or locale and kept our BCR and claims teams extremely busy. While COVID-19 affected our ability to travel and carry out onsite inspections of damaged properties, we instead met with Strata Managers, Committees, Insurers and Tradespeople in the virtual world to discuss and plan repair programs for our clients.

Whilst no amount of the efficiencies in the virtual world can ever replace face-to-face interaction, we see this digital change becoming an integral part of the future of insurance broking. Where attendance at meetings may once have been difficult for some, and even arranging a time and date that suited everyone was difficult, it seems virtual meetings are providing a solution and in many instances are more convenient for some clients. So, we are listening, and we encourage others to do the same.

Whatever new disasters mother nature brings, our mission remains unchanged – to unite and protect our strata communities. We must continue to digitise and innovate to remain relevant and provide the level of support our communities need.

BCB’s ability to adapt, in preparation for the unexpected, is another form of insurance, protecting our ability to protect our communities.

View Comments

(0)