The Critical Role of Building Valuations for Strata Insurance Coverage

Conducting regular building valuations for your strata property is extremely important. If you haven’t had a building valuation in the past 3 years, there is a high chance your building is underinsured.

Underinsurance has long been identified as an issue for many strata communities. It occurs when the sum insured does not meet the true cost of rebuilding, leaving properties vulnerable in the event of a major claim.

Regulation in most states across Australia indicates that building valuations should be conducted every 5 years, however, with the current state of the market, rate of inflation and many other factors affecting the costs of rebuilding and the value of your property it is vital that your ‘sum insured’ matches the real cost to rebuild should disaster strike.

Constructions costs

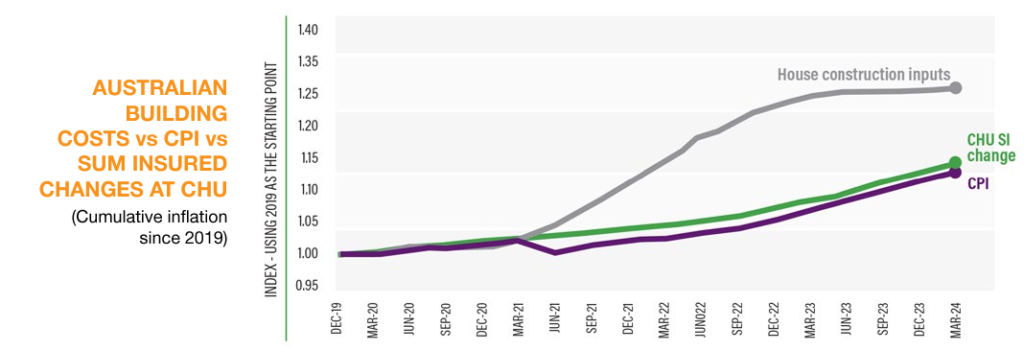

In recent years, we’ve seen construction costs steadily rise, influenced by inflationary pressures and market dynamics.

Costs can also vary during the project due to council and government regulations, unexpected delays and complications during construction.

An approximate breakdown of construction costs for building (Source: CoreLogic1):

- 40-45% allocated to cost of materials

- 35-40% of the total cost is labour

- Taxes and charges and other overheads such as professional fees

- An allowance for profit margin

Post COVID-19, Australia has seen significant rises in inflation and costs of living across the board. Couple this with material and labour shortages, unrest across the world, a spate of catastrophic weather events, the cost of construction and time to complete each project has compounded significantly.

Regular valuations can help mitigate this risk of underinsurance by ensuring that your ‘sum insured’ is keeping up with the rising costs.

Valuation considerations

An accurate building valuation ensures that the insurance coverage is sufficient for the actual rebuilding or repair costs. It helps property owners minimise the risks of being underinsured, providing peace of mind in knowing that their property is adequately protected.

A thorough valuation goes beyond just looking at the building’s structure. It considers various aspects, such as:

- The cost of buildings and common areas.

- External features, and the permanent fixtures within each lot inflation, rising material and labour costs.

- Additional expenses such as professional fees, compliance with regulations of building development, demolition and the removal of debris.

This comprehensive approach ensures that your insurance coverage covers all potential costs associated with rebuilding, providing peace of mind to owners and managers alike.

An accurate building valuation will assist owners by:

- Reducing financial risk: Underinsurance can result in significant financial risk for strata property owners. If a disaster occurs and the insurance payout is insufficient, the owners will be responsible for covering the shortfall, which can lead to financial strain and even bankruptcy for some.

- Avoiding costly insurance disputes: Accurate building valuations can help prevent disputes with insurance companies over the adequacy of coverage. By having a professional valuation conducted and providing evidence of the property’s true value, property owners can avoid potential conflicts during the claims process.

Obtaining a building valuation

- Engage a reputable valuer: Hire a professional valuer experienced in strata property assessments. They will conduct an independent assessment of the building’s replacement cost, take into account various factors such as location, construction type, and building regulations.

- Obtain regular valuations: While some jurisdictions require that valuations be obtained at least every 5 years, it is recommended to review more frequently, especially in the current inflationary market.

- Review your policy: Regularly review your insurance policies to ensure the building sum insured aligns with the most recent building valuation or alternatively, steadily increase in between formal valuations to keep pace with inflationary costs. Consult with an insurance broker to understand the coverage limits and any additional provisions that may be necessary.

Protection when it counts

Undertaking regular valuations will assist in minimising risk and safeguarding your strata investment. Whether it’s a minor repair or a major reconstruction, having the right insurance coverage can make all the difference in ensuring adequate support for claims and in the worst case, protecting you against the financial implications of a catastrophic event that may require a total rebuild.

At CHU, we understand the critical role that regular valuations play in protecting strata communities. We’re committed to helping owners and managers navigate the complexities of insurance and ensure their properties are adequately covered.

For more information about residential strata insurance or commercial strata insurance contact the CHU team or visit chu.com.au

Disclaimer: Insurance issued by QBE Insurance (Australia) Limited ABN 78 003 191 035 and distributed by CHU Underwriting Agencies Pty Ltd ABN 18 001 580 070 AFSL 243261. Any advice in this article is general in nature and does not take account of your personal objectives, f inancial situation and needs. Please read the relevant Product Disclosure Statement (‘PDS’), Financial Services Guide (‘FSG’), and the Target Market Determination (‘TMD’) which can be viewed at www.chu.com.au or obtained by contacting CHU directly. CHU Services Pty Ltd t/as CHU Inspect (ABN 99 616 086 269).

View Comments

(0)