Strata Insurance – Affordability and Availability Update

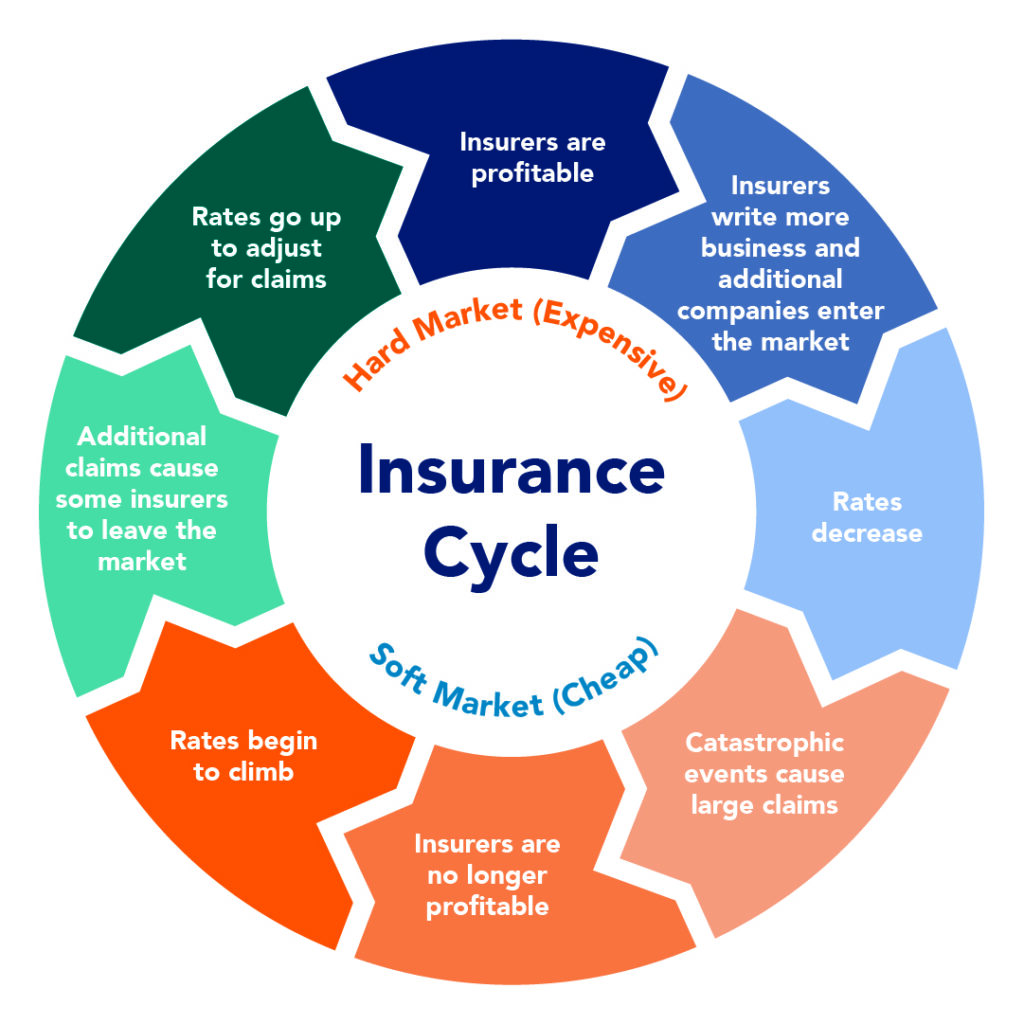

Financial markets go through hard and soft cycles, where the point in the cycle signals the direction for premiums and availability of cover.

Understanding the insurance cycle

External factors like climatic and economic events drive insurance cycles.

As insurer profitability declines following catastrophic claims events, insurers look for ways to reduce their overall risk, and the market hardens.

As insurers’ profits strengthen, the market softens. Insurers start to write more business, new entrants emerge, and premiums begin to plateau or even decrease.

Although it’s been several years since the last soft market, we see signs of change.

Market capacity has eroded over the last seven years, and risk assessment has become more selective. However, higher interest rates are now helping insurers build reserves for future claims payments, and some new underwriters are getting established in the market, bringing some helpful new capacity.

Insurers’ current appetite for risk

Insurance is about the transference of risk. When insurers look at a property, they do two things.

- Evaluate risk, ie the likelihood of a claim.

- Calculate the premium needed to cover the costs associated with the perceived risk, ie the reinsurance costs.

The higher the risk, the lower the insurer’s risk appetite, which can lead to a higher premium or no offer of cover.

A closer look at risk profiles and the impact of defects

Mainstream insurers want customers that present a “good” risk profile. That typically means a strata property with no, or only minor, defects, one that can evidence well-funded and planned remediation works, no hazardous construction elements, or is well maintained with a good claims history.

Owners have a statutory requirement to repair and maintain their property, address issues when they arise and avoid problems caused by neglect.

If an insurer requires a customer to rectify issues as a condition of providing insurance, it now insists that rectification work is well underway before it accepts the ongoing risk at the next renewal. Doing nothing can come at a considerable cost to the strata scheme, impacting all owners.

- Less choice of insurers

- Higher insurance premiums and excesses

- Imposed conditions of insurance

- Reduced level of insurance cover

- Claims declined

- Difficulty selling the property

The importance of valuations

In recent years, we’ve seen hard market conditions and a slowdown in the frequency of updated valuations. Strata legislation mandates that buildings be insured for their full replacement value, and it’s the strata scheme’s responsibility to ensure that insurance policy sums insured are sufficient to fully reinstate or rebuild the property following an insured event.

Owners are jointly and severally liable for any underinsurance. A qualified and skilled valuer can assess the cost of replacing the building based on the construction and quality of the existing property and assess the cost and time to replace it “as new”.

Understanding risk profiles in commercial tenants

There’s a very limited market for strata insurers willing to provide cover for high-risk activities, so many buildings with high-risk tenants now find it difficult to secure the required legislative insurance.

High-risk retail/commercial tenancies within a strata property, such as gymnasiums and tobacconists, can significantly increase insurance premiums for several reasons.

Claims risks

- Property damage: High foot traffic and the nature of activities in adult service venues increase the likelihood of property damage through vandalism and accidents.

- Fire hazards: Tobacconists carry a high fire risk due to the storage and sale of flammable products and improper disposal of smoking materials.

- Major incidents: High-risk businesses often experience major incidents, such as arson, armed robbery or police disturbances, requiring emergency services and usually leading to insurance claims.

- Risk management: Strata properties may need to invest in better security, fire safety and risk mitigation strategies. By improving their risk profile, they’ll achieve a return on investment through lower premiums over the long term.

Moral risks

- Criminal activity: Gymnasiums and tobacconists are sometimes linked with illegal activities such as drug use or human trafficking, which increases the likelihood of police raids and associated property damage.

- Theft and vandalism: Thieves target tobacconists and convenience stores due to the high value of their stock. This increases the likelihood of break-ins and vandalism.

- Legal issues: High-risk businesses may face frequent legal challenges or compliance issues, leading to potential lawsuits and increased legal fees for property owners.

Outlook for strata insurance premiums

While it’s premature to suggest we’re heading into “soft” market conditions, some strata schemes with good risk profiles are seeing much smaller premium increases than in recent years, and others are experiencing reductions thanks to the Cyclone Reinsurance Pool. However, if insurers experience heavy losses during the summer storm season, these recent premium improvements could stall.

To discuss strategies to help overcome the issues of insurance affordability and availability, contact your local BCB office.

View Comments

(0)