Navigating the Australian Strata Insurance Landscape

Talking about the weather is often an ice breaker before getting on to the real topic of conversation. For insurance, the weather is a big deal, as natural perils like cyclone, storm, and flood, are key components of a premium. The current strata insurance landscape has been shaped by recent weather events, coupled with inflation.

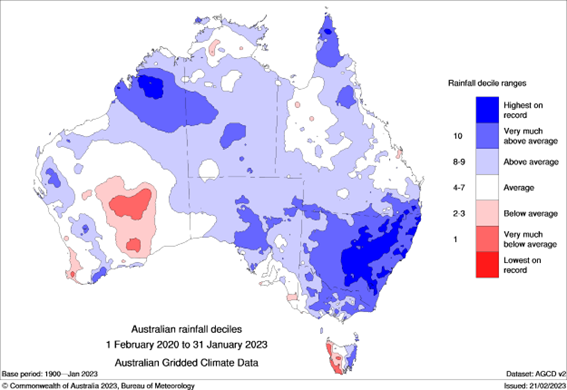

La Niñas impact on insurance premiums

In March this year, ABC News reported that La Niña’s three-year reign across Australia finally ended*. It was only the third triple La Niña since the 1900’s, bringing record rain to parts of south-east Australia and widespread major flooding. For much of New South Wales, it has been the wettest three years on record.

The Insurance Council of Australia (ICA)+ noted that premiums are being driven up by:

- the impact of extreme weather events in Australia

- the growing cost of reinsurance resulting from events in Australia and overseas and

- scarcer capital making riskier activities more expensive to insure.

Reinsurance costs rose to 20-year highs this year, with Australian insurers facing cost increases of up to 20 to 30 per cent.

Anecdotally, the ARPC Cyclone Reinsurance Pool has had a positive impact on reducing premiums in Northern Australia and SE Queensland, addressing affordability head-on. The same premium reduction is not yet evident for high-risk areas in NSW.

The inflation effect

When talking about why we are experiencing premium increases, the weather is not the only cause. During 2022–23, the cost of insurance has been impacted by very high inflation, like many other goods and services. The Cordell Construction Cost Index1 showed that residential construction costs rose 12 per cent in 2022, higher than CPI over the same period. This is driven by a shortage of labour and the high demand for materials, both increasing the average cost of insurance claims.

So what does this mean for your Owners?

The rising costs of capital and key components of insurance premiums have resulted in a hard insurance market, evidenced by:

- average premium increases of 15-20% for good risks with no claims

- standard excesses increased and more imposed excessed

- insurers reducing their exposure to risks with a poor claims history, defects, cladding, and high-risk occupancy such as tattoo parlours.

- lack of alternative quotes for non-standard risks

- tighter underwriting guidelines

- reduced capacity resulting in co-insurance of large buildings

- greater disclosure requirements for new quotes and on renewal

- Short-term policies of 3 or 6 months or decline on renewal where no action taken on issues

- pressure to dial down commissions.

As base premiums increase, so does the compounding effect of stamp duty, ESL (in NSW and TAS commercial policies) and GST. The ARPC Terrorism Levy is added to commercial policies and some large residential buildings. Several components of the total cost of insurance have GST applied including commissions, administrative fees, and the premium.

The Deakin University Report2 found that the national average of duties, levies and taxes was 27.5% of premiums cost, while NSW was nearly 40% due to ESL. The ICA and SCA National Strata Insurance Taskforce (SCANSIT) are lobbying the government to reduce, abolish or cap these charges on insurance premiums, fuelling underinsurance, particularly in times of increasing premiums.

Action plan

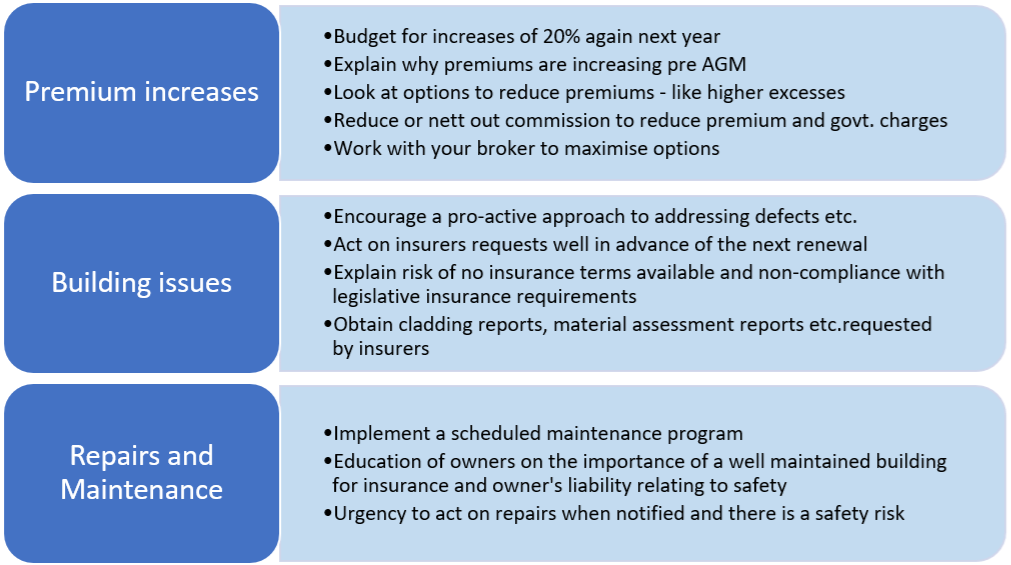

There are examples of strata managers losing policies and sometimes management agreements as disgruntled owners are faced with unexpected large premium increases and imposed excesses. Owners have increasingly opted to approach the direct insurer market (GIO, AAMI, etc.) due to premium savings even at the risk of reduced coverage.

Make sure you set expectations at the AGM and budget for 20% premium increases in 2024.

For buildings with outstanding defects or issues, give a strong warning that they may not get insurance next year if the insurer’s request for action is not met. Work with your broker on the messaging and action plan.

To help navigate the key challenges of the current market conditions we suggest the following:

After the strata insurance market undergoes a correction, we are hopeful that premium increases will be more measured, and owners understand the importance of rectifying building issues with a sense of urgency.

* ABC News https://www.abc.net.au/news/2023-03-10/la-nina-ends-australia-after-three-years/102077766

+ ICA Insurance Catastrophe Resilience Report 2022-23 https://insurancecouncil.com.au/resource/new-data-shows-historic-catastrophes-would-have-greater-impact-today/

1 Corelogic’s Cordell Construction Cost Index 4Q22.

2 A data driven holistic report understanding of strata insurance – Deakin University Report 2021

View Comments

(0)