Building business value as operational costs soar

Australia’s strata industry is flourishing. The last two decades of growth is equivalent to the previous 40 years, with cumulative rather than cyclical growth, as each release of lots adds to dwelling stock.

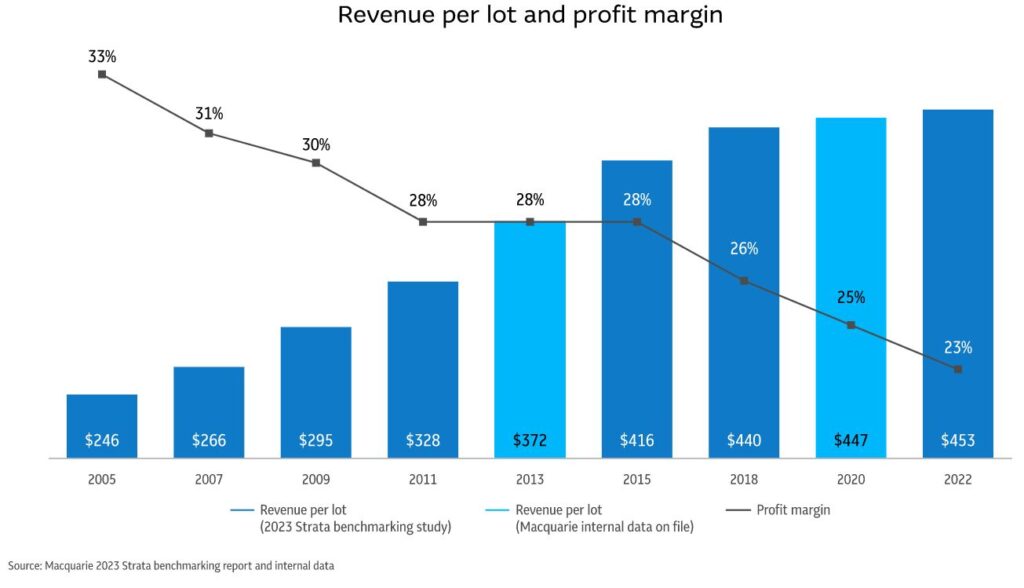

Yet despite industry growth, the 2023 Macquarie Strata Management benchmarking study uncovered that average profit margins have declined steadily from 33% in 2005, to 23% in 2022.

So, what’s driving this against a backdrop of consistent revenue growth? Could it be due to increased sophistication of schemes? Rising operational costs? The competitive environment? Or is it an imbalance between value provided to clients and cost to serve, with management fees per lot not keeping pace with inflation?

Investing to drive growth and profit

Businesses that outperform their peers recognise that high staff turnover impacts profits – and affects customer relationships. In 2022, our analysis showed that 33% of strata managers changed employers, compared to just 14% in 2018. For those businesses identified as outperforming in the industry, 74% retained strata managers, versus 64% in other businesses. The impact of losing customer-facing staff on lot owners, other employees, and business owners cannot be overstated.

In addition, salaries have trended upward from 29% of total revenue in 2005 to 49% in 2022. This is unsustainable from a cost control perspective, especially in the current inflationary environment. Additionally, higher salaries cannot be the only, or primary, lever for the attraction and retention of people. This risks feeding an environment of unsustainable competition, eroding business value.

To combat this, higher performers offer competitive renumeration packages to strata managers, linking business performance to total remuneration, made up of equity, performance incentives, and additional benefits. Higher performers also invest more in technology, using an average of 4.7 technology solutions, compared to 3.8 for other businesses, including customer portals and platforms, collaboration tools, and system integration software.

One opportunity for business owners is to consider longer-term plans. Key staff may have aspirations of business ownership and management, which is a powerful motivator and retention lever. With 40% of respondents reporting they want to remove themselves from day-to-day involvement within the next five years, there are abundant of opportunities to bring staff into these discussions.

As average profit margins decline, high performers have fewer lots per plan

The strata sector has remained resilient through the difficult trading conditions of the past three years. This is due in large part to residential construction industry tailwinds, with 76% of businesses enjoying revenue increases year-on-year. However, revenue growth per lot has significantly slowed to about 1% per year, not keeping pace with inflation and increasing operational costs, putting further pressure on margins.

So, what factors are contributing to this? Over the last decade, larger developments have increased in sophistication. They offer a variety of exciting services, such as concierges, security, cinemas, gyms and pools, and even retail. However, as schemes become more complex and diverse in their offering to residents, they’re also becoming more costly to manage. What’s more, strata businesses have had to recruit additional, and sometimes specialist, staff, or invest in training to ensure developments are managed well. The upshot is that rather than improving efficiency, lot growth is now increasing costs and making it harder for some strata businesses to achieve scale.

Higher performing businesses have focused on smaller plans. This gives them greater control over costs and risks and enables them to earn more revenue per lot.

In our view, the outlook for the strata sector remains strong. However, our analysis also reveals that shrinking profit margins are a persistent challenge. As strata management increases in sophistication and complexity, the need to recruit or train specialists – and then retain them – has never been more important. Yet this will mean salaries and operating costs will continue to rise – and these costs can no longer be absorbed. There is a compelling need to address costs charged to lot owners, incorporating value offered, in order to adjust the trajectory of the industry.

Macquarie Business Banking’s 2023 Strata Benchmarking report details the above key findings and breaks them down state by state so you can see how your business compares. The report also discusses in more detail the importance of people and culture as well as evolving business models, succession planning and how your business can put these data points and insights to work, now.

If you’d like to discuss the results, please contact your Macquarie Business Banking relationship manager, or request a call.

Read the full 2023 Strata Benchmarking report here.

This information has been prepared by Macquarie Bank Limited ABN 46 008 583 542 AFSL and Australian Credit Licence 237502 (‘Macquarie’) for general information purposes only and is based on statistics and information sourced from the Macquarie Business Banking Strata Benchmarking Survey conducted by Fiftyfive5 in late 2022 (‘the Survey’). This information does not constitute advice. Before acting on this information, you must consider its appropriateness having regard to your own objectives, financial situation and needs. You should obtain financial, legal and taxation advice before making any decision regarding this information.

View Comments

(0)